ad valorem property tax florida

Officer charged with the collection of ad valorem taxes levied by the county the school board any. Are Dental Implants Tax.

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. Understanding the procedures regarding property taxes can save. Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure.

The collection of taxes as well as the assessment is in. It includes land building fixtures and improvements to the land. 1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments.

A competent Florida tax attorney can help you navigate the difficulties of these challenges and answer any questions you may have regarding property tax exemptions and. Property Tax Oversight Program. Taxes on all real estate and tangible personal property and other non-ad valorem assessments are billed collected and distributed by the Tax Collector.

These tax statements are mailed out on or. An ad valorem tax is a tax that is based. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

PDF 106 KB Individual and Family Exemptions Taxpayer Guides. The sovereign right of local governments to raise public. This assessment determines the amount of ad valorem taxes owed each year on your property.

Authorized by Florida Statute 1961995. What is an example of an ad valorem tax. Property tax can be one of the biggest.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. Based on the assessed value of property. The community land trust model envisions that the.

Taxes usually increase along with the assessments subject to certain exemptions. Opry Mills Breakfast Restaurants. Ad Valorem taxes on real property and tangible personal property are collected by the Tax Collector on an annual basis beginning on November 1st for the calendar year January through.

Restaurants In Matthews Nc That Deliver. Real property is located in described geographic areas designated as parcels. Ad valorem ie according to value taxes are.

Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant. The greater the value the higher the assessment. Real property is located in described geographic areas designated as parcels.

Ad valorem or property taxes are collected annually by the county tax collector. The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes and railroad. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. TAX COLLECTIONS SALES AND LIENS. Ad Valorem Taxes.

Ad valorem means based on value. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. A lien against property.

Florida Department of Revenue. It includes land building fixtures and improvements to the land. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

SECTION SIX - AD VALOREMY TAXES IN FLORIDA There are several questions to be addressed in regard to ad valorem taxation in Florida. The most common ad valorem taxes are property taxes levied on. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older.

Non Ad Valorem Assessment is a charge or a fee not a tax to cover costs associated with providing specific services or benefits to a property. An ad valorem tax is a tax based on the estimated value of an item such as real estate or personal property. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Taxing Authorities and Non-Ad. Ad Valorem Property Tax Florida.

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Understanding Your Tax Bill Seminole County Tax Collector

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

An Investment In Knowledge Always Pays The Best Interest Floridatitlecompany Realestateattorney Www Marinatitle Com Investing Estate Lawyer Real Estate

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law

Explaining The Tax Bill For Copb

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Understanding Your Tax Notice Highlands County Tax Collector

Tax Prorations Explained For Florida Real Estate Closings Part 2

Real Estate Property Tax Constitutional Tax Collector

A Guide To Your Property Tax Bill Alachua County Tax Collector

Real Estate Taxes City Of Palm Coast Florida

Broward County Property Taxes What You May Not Know

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

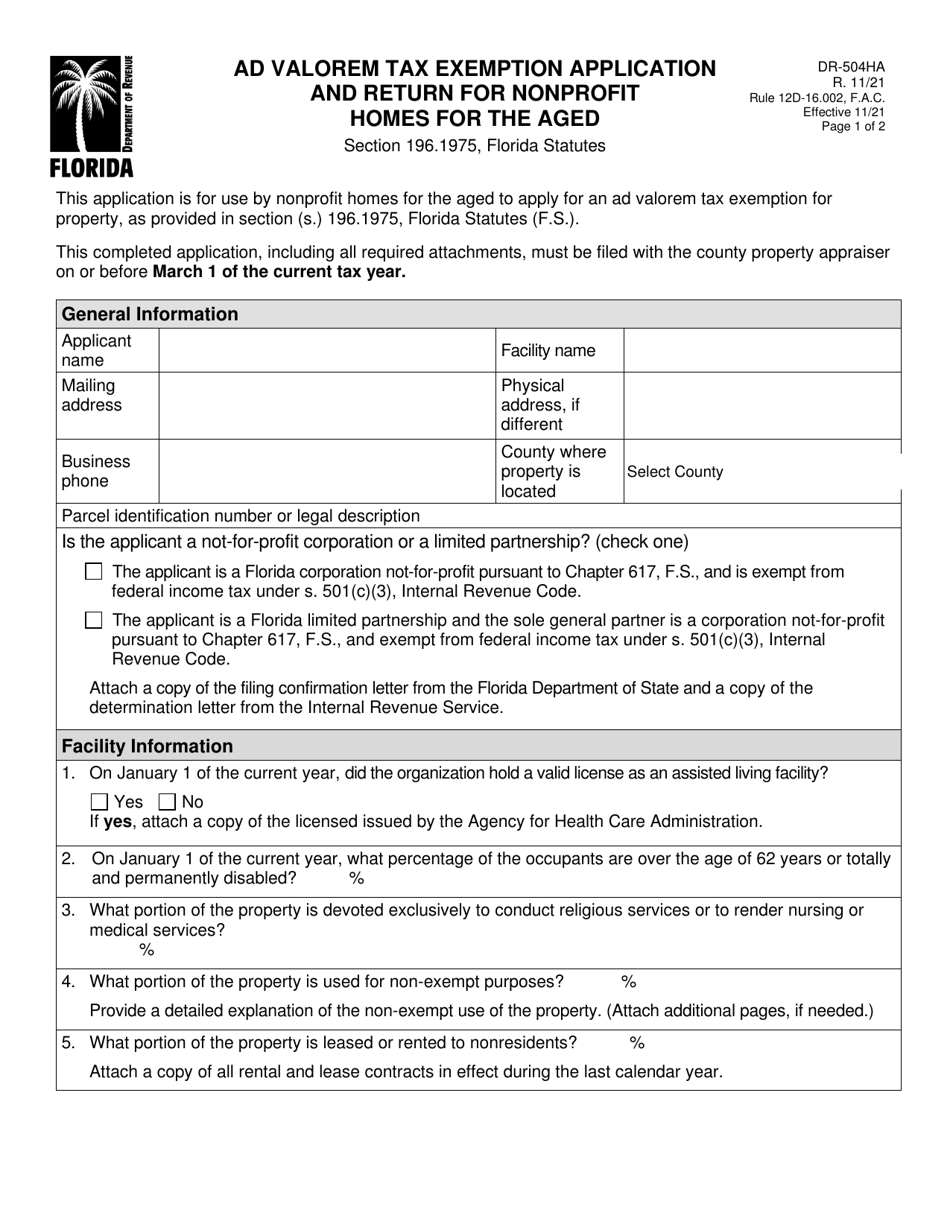

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida